The photography insurance you probably don't have (but definitely need)

This is the ultimate checklist for professional photography insurance. Ignore it at your peril!

The best camera deals, reviews, product advice, and unmissable photography news, direct to your inbox!

You are now subscribed

Your newsletter sign-up was successful

Photographers are a ham-fisted bunch. At least, that’s one way to interpret the statistics.

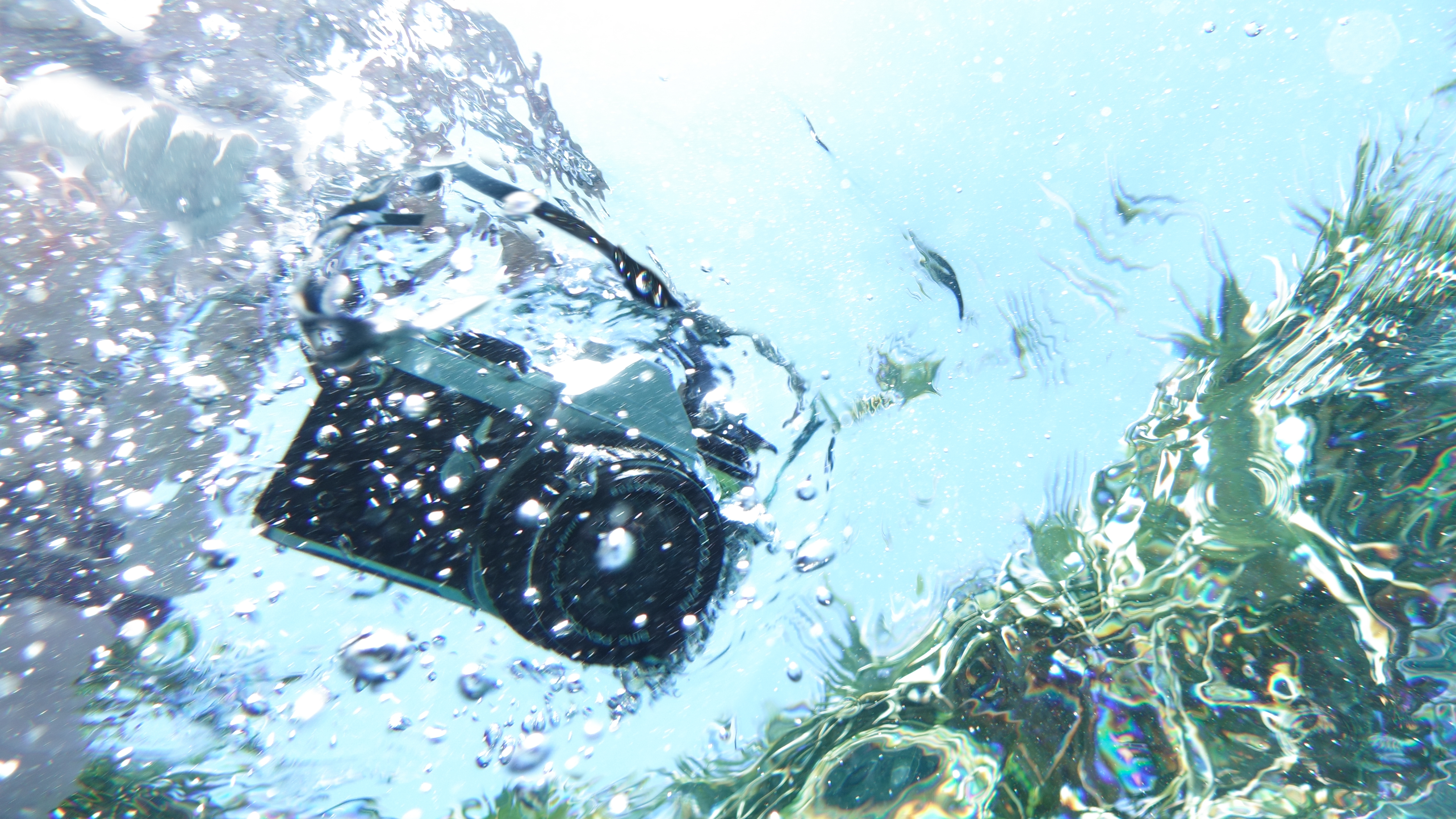

In the 2014 records of Towergate Insurance Brokers, 93 out of 100 insurance claims from professional photographers were related to accidental damage. And at InFocus Insurance, "people dropping kit and kit getting wet" are the most common claims. Specialist insurer Photoguard’s records show a very similar pattern.

"The most common claim tends to be accidental damage," says Stephen Knowlson, communications coordinator at Thistle Insurance, which sells Photoguard’s insurance cover. "Constant use raises the likelihood of a claim, from tripods knocked over to spilled drinks. Photographers can be as clumsy as everyone else, and it’s hard to keep an eye on all the equipment all the time."

Although gear is the main thing photographers look to protect when they first contact insurance companies, it’s important to look outside physical kit alone when researching policies. A surprising number of professional and semi-professional photographers are unaware of the many risks they are taking in their jobs.

"People most often come to us looking for cover for their equipment," says Mark Pitcher, head of ecommerce at insurance broker Policy Bee. "But we advise professionals to also include public liability because it can be a contractual need, and we also recommend that you get professional indemnity cover so you’re covered if a client claims you’ve been negligent and they’re trying to get compensation off you."

This trio – equipment cover, public liability and professional indemnity – is commonly offered and recommended by most insurance brokers, but some photographers can’t tell them apart.

Public liability insurance, which protects you against claims from others who suffer a loss or injury as a result of your business activity, is well-known and required by many venues. But professional indemnity insurance, which protects you if a client sues you for not having done your job (or not having done it well enough) is still a lesser-known and misunderstood concept.

The best camera deals, reviews, product advice, and unmissable photography news, direct to your inbox!

"Professional indemnity is particularly useful for those working in commercial and wedding sectors, but some people confuse this with public liability," says Thistle's Knowlson. "Photographers tend to be artists first, business people second, so this type of cover, protecting against client disputes and the inability to fulfil a contract, can be overlooked."

Nevertheless, it’s risky to skimp on this. Towergate Insurance Brokers has seen

a 25% increase in professional indemnity claims received from third parties. "The claims are partly a result of customers not being happy, and partly due to the photographer being unable to fulfil the contract," says Kristofer Taylor, Towergate’s senior new business executive.

At Policy Bee, 10% of last year’s claims from photographers were professional indemnity claims. "It tends to be a result of the client being unhappy with the result of the photos or video. We’ve also seen several claims where the insured has lost the photos," says Pitcher of Policy Bee.

"The insurer generally pays compensation to resolve the professional indemnity claims – from our experience, on average £600."

As well as equipment, public liability and professional indemnity – and possibly studio insurance, depending on your setup – professional photographers also have the option of guarding themselves against the modern ills of the digital age.

"The thought of losing images through backup failure, data corruption or damaged storage accessories can be daunting to photographers. This has proven a very valuable element of insurance," says Taylor at Towergate. By insuring yourself against digital accidents, the cost of reinstating your lost data can be covered by your insurance.

At Photoguard, this concept has a name – 'cyber liability' – and it also covers you against malicious cyber attacks. "It’s a fairly new thing, which reflects the realities of our digital world," says Knowlson at Thistle. “Many pros these days have cloud-based storage for their images, but as we all know, there’s been a number of hacking attacks, for example, against TalkTalk a few years ago, which resulted in a lot of customer data being lost."

If a photographer is attacked by hackers, and data – such as images – is compromised, the photographer has a duty to inform the client about the breach. The client can then, in theory, sue you. So what Photoguard’s cyber liability add-on does is protect the photographer in the event of such a data breach. The cover will pay legal costs and any costs associated with reinstatement of that data.

"It’s only really been in the last 18 months that this has emerged in the marketplace," says Knowlson. "And that’s basically because of the vast popularity of storing images in the cloud. We haven’t sold a lot of it yet, but there’s definitely a trend towards cyber liability in the wider insurance market, and it’s something we’ll be seeing more of in the future."

Even if you’re not using the cloud, it’s worth investigating how well your policy covers digital loss. Cyber liability cover includes loss of data from USB sticks and any lawsuits you might face from not keeping the client’s data safe.

Of course, your data isn’t the only thing that can be damaged in the digital age. At InFocus Insurance, 'crisis containment' cover will help you prevent a social-media catastrophe in the event that an unhappy client starts throwing digital mud.

"Some people aren’t sure what to do in such situations, and might get into arguments with the client on social media, and sometimes things could be better handled with a bit more diplomacy," says InFocus director, Peter Stevenson.

"If it’s an allegation of professional negligence – that is, that they’ve not done their job well – our policy will provide for a PR consultant to help with the management of the process."

Getting professional help

Another phenomenon of the digital age, thanks to search engines and internet instructional videos, is the common pastime of DIY equipment fixes and hacks. If your camera breaks and you think you might be able to fix it with a little help from YouTube, beware that you might be compromising your insurance cover.

"There’s a lot of good advice online, but often it’s just people passing opinions. If you search for advice online, then you go off and do something that destroys the camera permanently, the insurer might turn around and say it’s not insurable because it’s a DIY job," warns Stevenson.

Even if you’re not trying to destroy your camera, breaking it by trying to fix it is different from breaking it by dropping it – and will be considered a deliberate act, as opposed to an accident.

The same trend has caused an upsurge in legal 'self-help' among photographers and other self-employed people. "People tend to stumble through things, like setting up their own contracts," says Stevenson.

"But sometimes they can get quite a lot of help via trade associations like the Society of Wedding and Portrait Photographers (SWPP) or the Guild of Photographers [both in the UK]. Usually, insurance policies will provide free legal helplines as well, which is rarely taken advantage of."

Incidentally, trade associations are also a good source of good insurance deals. The SWPP, for example, offers a £2 million public liability and £75,000 professional indemnity package for £115 through Aaduki.

Aaduki is an insurance broker, so isn’t tied to any specific insurer. This means that it can search the whole market for the most appropriate cover for each type of photographer. There are also good insurance deals to be found at trade shows such as The Photography & Video Show in Birmingham or the Societies’ Convention in London.

Going sky high?

If you’re one of the many photographers who have invested in a drone, this may be an additional area you need to look at. Drone photographers are taking new risks that aren’t necessarily covered by their regular insurance policy.

Phoenix-based insurer, Hill & Usher has been insuring drones for over eight years and has recently experienced an increase in demand for Unmanned Aerial Vehicle (UAV) cover. But due to the drawn-out process of the Federal Aviation Administration (FAA) clarifying regulations on drone use in the US, the drone insurance market is still a bit like the wild west.

"The aviation liability policies vary fairly significantly from carrier to carrier at this point," says Todd Landfried from Hill & Usher.

"Some will not write where UAVs are used near crowds, such as weddings or concerts. Some will write if the insured can demonstrate a high degree of knowledge as to how to safely fly in such situations. Some will authorize the use of very small UAVs indoors, while others will strictly prohibit indoor use. Some will cover the use of non-owned UAV units and contracted 'freelance' pilots, some won’t."

In any case, Landfried stresses, you’ll need extra cover if you’re using drones in a professional capacity. "Nearly all ground policies specifically exclude coverage and claims resulting from the operation of any aircraft, including a UAV," he says. "In fact, many carriers will cancel your policy completely if they learn that you fly UAVs and that you have not purchased specific liability insurance for doing so."

In the UK, regulation is simpler and causes less headaches for insurers and photographers. “You don’t have to have a license to get insured, but there are rules stipulated by the Civil Aviation Authority that you need to follow. If you breach them, it will invalidate your insurance,” says Knowlson.

Theft and recompense

The second-most common insurance claim from photographers – after accidental damage to equipment – is theft. Most policies cover theft, but it’s important to study the fine print of your policy to make sure that you’re aware of its limitations, particularly if your kit is covered under your household insurance.

"A lot of the policies we’ve seen tend not to cover kit in vehicles overnight when left unattended. They’ll limit the value of kit, or they’ll only cover it in daylight hours. There are all sorts of little things in insurance policies that can trip photographers up," says Stevenson.

InFocus will cover your insured kit in your vehicle all night, and there are other insurers who take a similar approach.

"As a photographer, office hours do not really apply. You may be out to get a sunrise shot at 4am, or working a wedding until midnight. Flexible cover is required," says Knowlson from Thistle. At Policy Bee, records show that the most expensive claims, to the insurer, are the ones that are made as a result of theft from a location – a home or a studio.

"The insurer generally has to pay between £5,000 and £10,000 for these types of claims from photographers," says Pitcher. "It's deemed 'portable equipment', but it’s still covered when stored at a location."

Stevenson advises that photographers check exactly what’s covered under the 'theft' category in their insurance.

"We’ve just paid out a claim for £13,000 where a van was broken into, and there were no visible signs of a break-in. But the insurer paid it on the basis that the police reckoned that the car had been accessed with some sort of device that disabled the locks and alarms. Some policies exclude cases where alarms have been disabled and there is no sign of a break-in."

Many insurance companies only require you to itemize very expensive pieces of kit in your collection, but you do have to list the value of everything else – the cost of replacing it as new.

This, of course, changes depending on which new models your kit manufacturer brings out, so it’s worth checking every year when you renew your insurance policy. If you don’t, it can come back to bite you. This is what insurers refer to as the 'average condition'.

"This is an area that does get misunderstood. If you insure for £5k of equipment, but you actually have £10k of equipment in total, you’ll be deemed underinsured, and if there’s a claim, the insurer can reduce what it pays in direct proportion to the degree that you’re underinsured," explains Pitcher.

Commercial photographer Tom Barnes learnt this the hard way. "Canon brought out an update to a lens I had, and almost doubled the price on it. I didn’t increase the lens replacement price on my insurance schedule to reflect this, so when it broke, I had to pay the difference. I ended up paying £600 of my own money to fund a replacement."

Taylor at Towergate recommends that you check the prices of the latest equivalents to your kit on the market today. "Don’t forget, if you are VAT registered, you can deduct this element from your total value," he adds.

One final piece of advice from Knowlson: "Itemizing every single piece of kit, even if it’s not required, will help you keep track of its total value."

You might also like…

Take a look at the best mirrorless cameras and the best camera drones on the market today.

Kathrine has been working as a professional journalist for 12 years, and her clients have included Professional Photography, Nikon Pro, Canon, The Daily Telegraph, Professional Photography magazine, Phaidon, World Photography Organisation, Black and White Photography magazine, and The Ecologist. Danish clients include Politiken, Digital Foto, and Berlingske.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.