As America and Europe sales crumble, is China now the most important camera market?

CIPA's 2023 report shows a staggering increase in the Chinese market, will this shape the future of photography?

The best camera deals, reviews, product advice, and unmissable photography news, direct to your inbox!

You are now subscribed

Your newsletter sign-up was successful

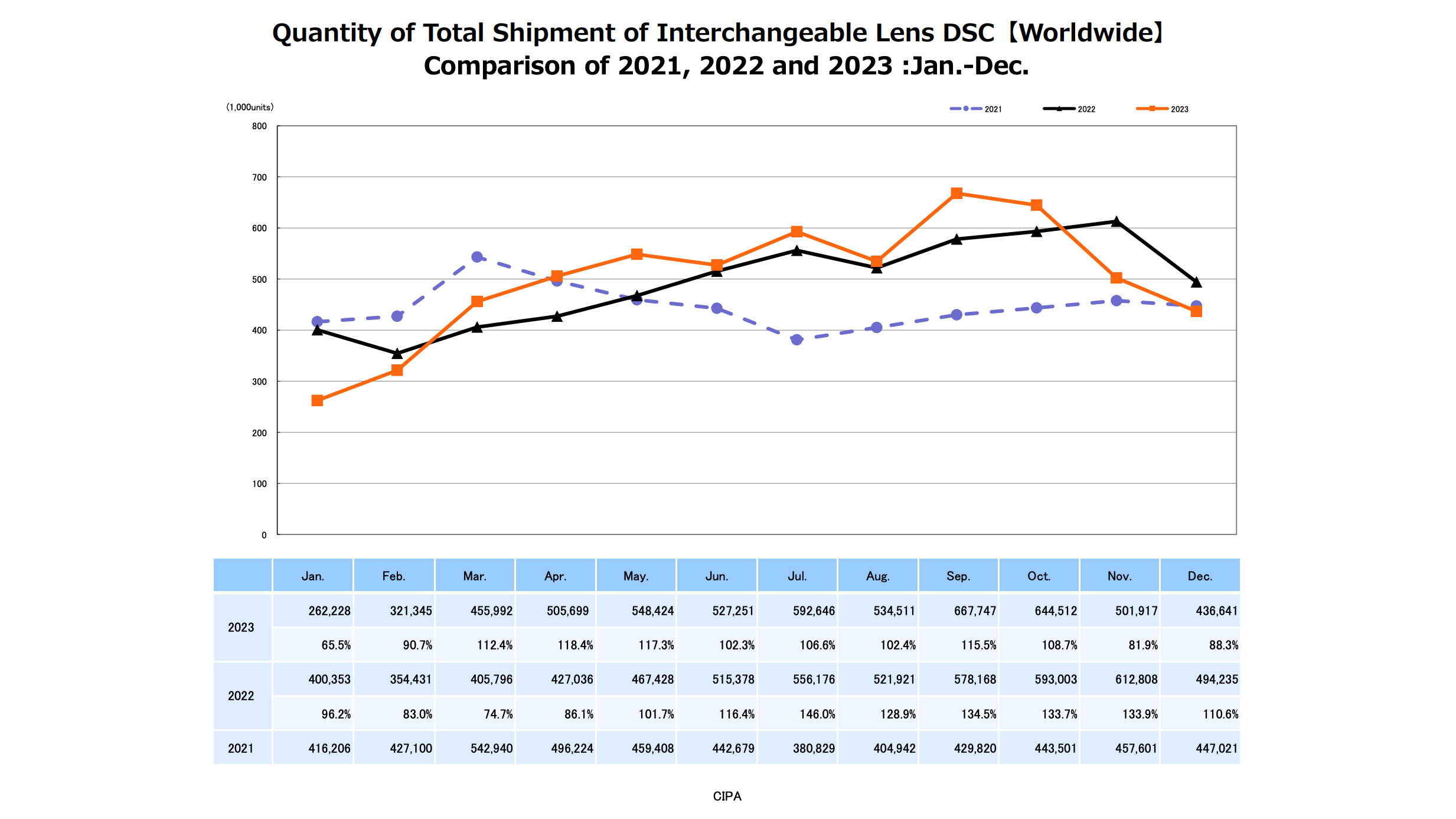

CIPA (Japan's Camera and Imaging Products Association) has released its full 2023 report, analyzing the spending and shipping of digital cameras worldwide and it makes for some very interesting reading that may suggest the future of the digital camera market.

The Japanese industry association's report analyzes the data of digital camera sales by Japanese manufacturers across the global market, this takes into account all digital cameras including the best mirrorless cameras, DSLR cameras, and compact cameras.

By looking at the report from CIPA, the first notable point of interest is the global shipment value of digital cameras in 2023 increased by 5% on 2022, the third consecutive year that there has been a positive increase.

The total spend equated to 714.3 billion yen, equivalent to just shy of $5 billion or just under £4 billion. The increase in the spending total does not necessarily mean a high volume of units being sold, as the average unit price has also increased to a new high of 90,000 yen ($615 / £481).

Mirrorless cameras continue to drive market growth accounting for 80% of the total market, expanding the gap between mirrorless and DSLR further. The number of units shipped increased by 19% to 4.83 million units, with the total combined sales jumping 11% to 580.4 billion yen ( $4 billion / £3 billion).

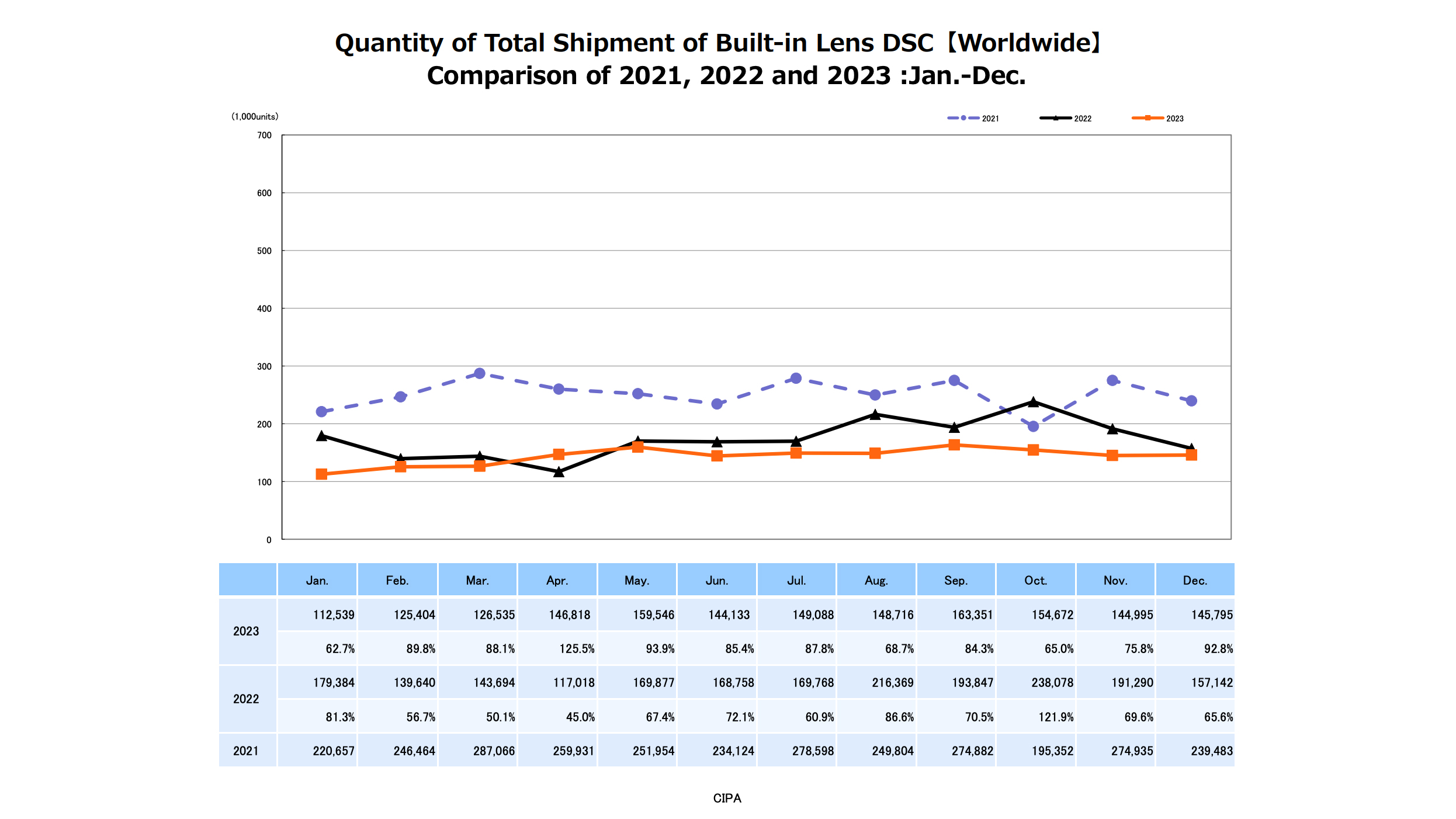

The data also shows an increase in the value of fixed-lens compact cameras by 9% being exported – despite another marked drop in the actual number. The fixed lens premium compact is one being considered by many more photographer - offering a smaller portable camera that still boasts superb image quality. I use a Fujifilm X100F as an everyday carry, due to its small form and ease of use for spontaneous shooting, so I can attest to the advantages of fixed-lens cameras.

Where the data starts to get really interesting, and where it can have a very significant effect on the photography world, is how the total spend is broken down into regions. China had the largest increase by a staggering 25% to 179.9 billion yen ($1.25 billion / £1 billion). We have known for some time that China has been a growing market, but the data gathered in 2023 shows to what extent - a huge one!

The best camera deals, reviews, product advice, and unmissable photography news, direct to your inbox!

The Chinese market favors buying from Chinese companies and its lens and camera manufacturers have been increasing the quality and advancing the technology. Despite this, imports from Japan have risen dramatically.

Japan is another region that shows increased sales by 4% while Europe and the US both show a decrease of 7% and 1% respectively. While the eastern market continues to grow exponentially, the western market in Europe and the US falls flat.

It has been reported that Chinese consumers are buying more affordable cameras, and vlogging cameras so it will be interesting to see how the manufacturers react to the demand of a now very large portion of the market. Will we see the return of more entry-level mirrorless cameras? Perhaps more variations of fixed-lens cameras? Or cameras with increased vlogging features? Time will tell, but I imagine an upcoming shift in line with this increased Chinese influence.

Kalum is a photographer, photo editor, and writer with over a decade of experience in visual storytelling. With a strong focus on photography books, curation, and editing, he blends a deep understanding of both contemporary and historical works.

Alongside his creative projects, Kalum writes about photography and filmmaking, interviewing industry professionals, showcasing emerging talent, and offering in-depth analysis of the art form. His work highlights the power of visual storytelling.