Starting a photography business? Here are 10 practical things you need to get up and running

Dreaming of going full-time with your camera? Start with these 10 essentials to get your business running smoothly

So you're turning your passion into a proper business. Exciting times... but also slightly terrifying. Between camera bodies, lenses and lighting gear, you've already spent a small fortune on the creative side of things. Now comes the less glamorous bit: setting up an actual, functional workspace where you'll spend hours editing, invoicing clients, and managing your growing empire.

Thankfully, you don't need to blow thousands on fancy office equipment or expensive software subscriptions. What you do need is a setup that keeps you comfortable, organized and secure while you build your business.

To help you out, I've picked 10 essentials that'll genuinely make your life easier, from the standing desk that'll save your back during marathon editing sessions to the password manager that'll stop you using "Photography123" for everything. And to make things even simpler, I've picked my favourite examples of each product available today.

1. Best standing desk: Flexispot Adjustable Standing Desk Pro

Let's be honest: photographers spend way too much time hunched over their desks. Between culling hundreds of shots, fine-tuning edits in Lightroom, and invoicing clients, you're essentially glued to your chair. That's why a standing desk isn't just nice to have – it's essential for your back, your posture, and honestly, your sanity. The ability to switch between sitting and standing throughout the day keeps your energy up and stops that 3pm slump from turning into a full-blown meltdown.

My top pick is the Flexispot Adjustable Standing Desk Pro, thanks to its combination of stability, smooth electric height adjustment and stylish design. Available in bamboo, rubberwood, laminate or soft wood, it comes in various sizes (48–80 x 24–30 inches) and finishes from black to oak.

The desk adjusts smoothly from 25 to 50.6 inches (58–123cm) and can store up to four preset heights. With a solid 440lb weight capacity, it’s sturdy enough for heavy equipment. Some assembly is required, but the clear instructions make this manageable within an hour or so.

Overall, this desk is well-built, attractive, reliable and well worth the money. If it's beyond your budget, though, my best affordable alternative is the Ikea Trotten.

2. Best chair: Humanscale Freedom

Here's the thing about running a photography business that few people ever say out loud: you'll spend more time in your chair than behind your camera. Between editing sessions that stretch for hours, client consultations over Zoom, and admin work that never seems to end, your chair is basically your most-used piece of equipment.

A low-quality chair may be cheap, but over time you'll run the risk of back pain, shoulder tension, and those dreadful headaches that creep in by mid-afternoon. You can't deliver your best work when you're fidgeting every five minutes trying to get comfortable, so to my mind, it's worth spending as much as you can on a decent chair.

The Humanscale Freedom is genuinely in a different league – this is the chair you buy when you're serious about your workspace. It's pricey, but hear me out. Designed by ergonomics pioneer Niels Diffrient, it ditches every lever, dial, and knob you've ever wrestled with on other chairs. Instead, it automatically adjusts to your body weight and movements. Lean back and it reclines with you, the armrests move with the backrest, and the contoured cushions adapt without you touching a thing.

In short, this is like the Tesla of office chairs; slightly weird at first, then you wonder how you ever lived without it. If it's beyond your budget, though, then my best affordable alternative is the Sihoo M18 Ergonomic Chair.

3. Best credit card reader: Square

Cash is basically dead, and if you're still asking clients to "pop it in the post" or faff about with bank transfers, you're making life harder than it needs to be. Whether you're shooting on location, running a studio session or selling prints at a local market, you need a way to take payments on the spot. It's professional, it's convenient and honestly, you'll get paid faster – which matters when you're managing cash flow in those early months.

Square Reader is the no-brainer choice here. It's tiny, dead simple, and doesn't cost much at all. Just a small square gadget that connects to your phone or tablet via Bluetooth. Clients tap their card, Apple Pay or Google Pay, and you're done. No clunky PIN pad, no complicated setup – it just works. The money hits your account the next working day, which is brilliant when you need to pay for props or cover equipment costs quickly.

Transaction fees are fair, with no monthly charges eating into your profits. But here's where Square really shines: the app is packed with genuinely useful tools. You can manage invoices, track inventory, generate sales reports, even create digital gift cards or payment links for remote clients. Customer support is solid too: phone, email, and chat available during business hours. For a photography business just starting out, it's everything you need without the faff.

4. Best camera insurance: Hiscox

Now let's talk about the stuff nobody wants to think about until it's too late. Your camera gear is expensive – really expensive. A decent body, a couple of lenses, a flash, maybe a drone... you're easily looking at $5,000+ worth of kit. Now imagine dropping your camera during a wedding, having it nicked from your car, or watching your bag disappear at an airport. Without insurance, that's your business crippled overnight. You simply can't afford to wing it.

Hiscox understands photographers properly. They've insured over 600,000 small businesses across 100+ years, and their photography policies are built around how you actually work. You get comprehensive equipment coverage for cameras, lenses, lighting, drones – the lot – plus crucially, proper liability insurance. That last bit matters more than you think: if you're shooting on someone else's property (weddings, corporate events, private homes) and something goes wrong, liability cover protects you from devastating legal costs.

What sets Hiscox apart is flexibility. Coverage works worldwide (ideal for destination shoots), payments are manageable, and they're known for responsive claims handling when disaster strikes. You can bundle general liability, professional liability, cyber insurance, and equipment cover into one policy. It's professional, it's thorough, and it's designed for working photographers, not hobbyists.

5. Best ethernet cable: AmazonBasics RJ45 Cat 6

Wi-Fi is convenient, sure, but when you're uploading massive RAW files to the cloud, transferring wedding galleries to an external drive, or video-calling a client without buffering like it's 2005, you need a proper wired connection. Wi-Fi is fine for browsing Instagram, but for the heavy lifting photographers do daily – backing up shoots, syncing with cloud storage, downloading software updates – ethernet is faster, more stable, and frankly, just more reliable. No dropouts, no mysterious slowdowns, just consistent speed.

The AmazonBasics RJ45 Cat 6 Ethernet Patch Cable is about as unsexy as gear gets, but that's exactly why it's perfect. It's cheap, it works, and it does exactly what it says on the tin. Cat 6 delivers speeds up to 1Gbps, which is more than enough for most photographers, even if you're shifting hundreds of gigabytes around your network. Unless you've got a mega-fast business broadband connection, this cable won't be your bottleneck.

It comes in various lengths (0.9m up to 7.6m), so you can run it from your desk to your router without excess cable cluttering your workspace. You can also buy them in multipacks, which is handy if you're setting up a studio or want spares. There's nothing fancy here – no gold-plated connectors or braided sleeves – but honestly, you don't need that. This cable is reliable, affordable, and gets the job done without fuss.

6. Best WiFi Extender: TP-Link RE700X

If you're running a photography business from home, chances are your router lives in some random corner dictated by where the phone line enters the house – probably nowhere near your office.

That means patchy WiFi, which is a nightmare when you're trying to upload client galleries, join video calls without freezing mid-sentence, or work from different rooms. A weak signal isn't just annoying; it actively costs you time and makes you look unprofessional when a client call keeps dropping out.

The TP-Link RE700X WiFi Range Extender solves this without breaking the bank or requiring a degree in networking. It's nicknamed the "dead-zone killer" for good reason – plug it into a socket roughly halfway between your router and your office, and it extends your WiFi coverage to those problem areas. Plus it supports WiFi 6, which means it's fast and future-proofed for the next few years as more devices support the standard.

Setup is genuinely simple through the TP-Link app. There's also a Gigabit Ethernet port on it, so if you want a wired connection in a room where running cables is tricky, you can plug straight into the extender. It's compact, doesn't hog your power socket (though annoyingly there's no passthrough), and most importantly, it just works.

7. Best VPN: NordVPN

When you run a photography business, you're constantly moving sensitive data around: client files, contracts, payment details, and more. So whether you're uploading galleries from a cafe, backing up shoots on public WiFi at a hotel, or accessing your cloud storage while travelling, you need protection. Without a VPN (Virtual Private Network), anyone on that network can potentially snoop on what you're doing. And if you're working internationally or accessing geo-restricted websites and resources, a VPN becomes even more essential.

NordVPN is the best all-rounder out there. It's fast, covers 111 countries with 7,000+ servers, and keeps your connection rock-solid whether you're working from home or halfway across the world. Setup is straightforward across Windows, Mac, iOS, Android, even Fire Stick – and the interface makes sense without needing a tech manual.

Security-wise, it's bulletproof: military-grade encryption, a strict no-logs policy, and it's based in Panama, so there are no dodgy data retention laws to worry about. It's not the absolute cheapest option, but for what you get – speed, security, and reliability – it's worth every penny.

8. Best antivirus software: Norton 360

Let's be brutally honest: your computer holds your entire business. Client details, contracts, invoices, years of work, login credentials for everything; it's all sitting there. One nasty bit of malware, one ransomware attack, or one phishing email you click by mistake, and you could lose the lot. "It won't happen to me" is what everyone thinks until it does. You need proper antivirus protection, not just the basic stuff that comes with Windows. This isn't optional when your livelihood depends on your machine staying clean and functional.

Norton 360 is the gold standard here, and the Deluxe plan is the sweet spot for most photographers. It covers up to five devices (your main computer, laptop, phone, tablet, whatever) with a single subscription. You get bulletproof malware protection, a smart firewall that blocks dodgy connections, and 50GB of cloud backup for critical files. Setup takes minutes, it runs quietly in the background without slowing your machine, and there's a 60-day money-back guarantee if you're not convinced. Yes, it jumps in price after year one, but for comprehensive protection across all your devices, it's worth it.

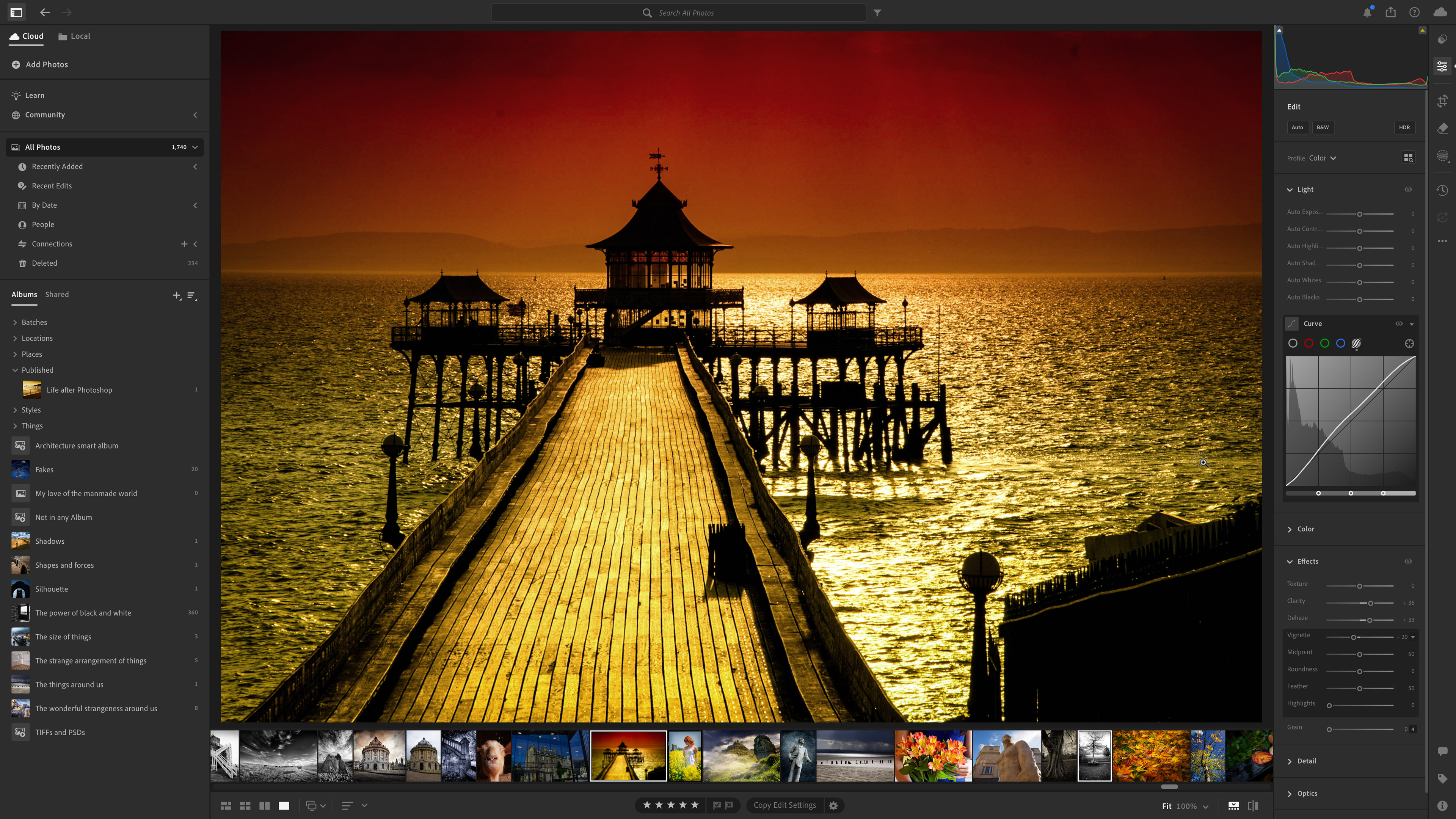

9. Digital asset management software: Adobe Lightroom

Here's a harsh truth about running a photography businesses: if you can't find your files, you might as well not have taken them. You'll accumulate thousands – probably tens of thousands – of images within your first year. Wedding shoots alone can generate 2,000+ photos per event. Without proper organization, you'll waste hours hunting for "that one shot from the spring portrait session" or desperately scrolling through folders trying to find last year's corporate headshots. It's not just annoying; it costs you money and makes you look disorganized when clients ask for specific images.

Adobe Lightroom is the answer, especially if you work across multiple devices. For a monthly subscription, you get the full editing suite plus 1TB of cloud storage, which means your entire library lives online and syncs everywhere: desktop, laptop, tablet, phone. Shoot on your camera, import on your laptop at a client's office, make final tweaks on your tablet at home. It just works, and you're never stuck without access to your images.

The interface is clean and intuitive, miles better than the cluttered feel of older software. AI-powered search is genuinely brilliant; type "architecture" or "blue dress" and it finds matching images without needing manual keywording. The editing tools are industry-standard (every professional knows Lightroom), with excellent AI noise reduction, powerful masking and thousands of presets. Mobile apps are slick and genuinely useful for on-the-go edits or quick client previews.

Yes, it requires internet and a subscription, but for modern workflows, it's unbeatable. For more details, read our Adobe Lightroom review.

10. Best password management software: NordPass

Finally, let's talk about passwords. If you're using the same password across multiple sites (or variations like "Photography2024" and "Photography2025"), you're one data breach away from disaster. Hackers don't need to target you specifically: they buy leaked password databases from other breaches and try them everywhere. Your email, banking, cloud storage, client portals, payment processors... all potentially compromised because you reused a password from some random forum you signed up to five years ago. Running a business means you're a target, and weak password hygiene is the easiest way in.

NordPass sorts this mess out properly. You get unlimited password storage, automatic syncing across all your devices, and a password generator that creates genuinely uncrackable passwords for every single site.

You only need to remember one master password – NordPass handles everything else, auto-filling logins on websites and apps so you're never stuck hunting for credentials. Best of all, the interface is clean and intuitive; honestly, this one of the easiest password managers to actually use. There's even a free tier if you want to test it first.

The best camera deals, reviews, product advice, and unmissable photography news, direct to your inbox!

Tom May is a freelance writer and editor specializing in art, photography, design and travel. He has been editor of Professional Photography magazine, associate editor at Creative Bloq, and deputy editor at net magazine. He has also worked for a wide range of mainstream titles including The Sun, Radio Times, NME, T3, Heat, Company and Bella.